Give with FreeWill

If you’re thinking about your charitable legacy, drafting a will, changing beneficiaries and giving through your retirement plan assets seem like overwhelming task, you might consider using FreeWill—a safe, easy-to-use platform that makes it convenient to manage your estate plan online.

- You are never too young to do estate planning

- Even if your property is titled in joint tenancy with your spouse you still need a will

- Estate planning is not only for the super-rich

- Estate planning shouldn’t be complicated and expensive

- If you did your will years ago there often a need for revision and further planning

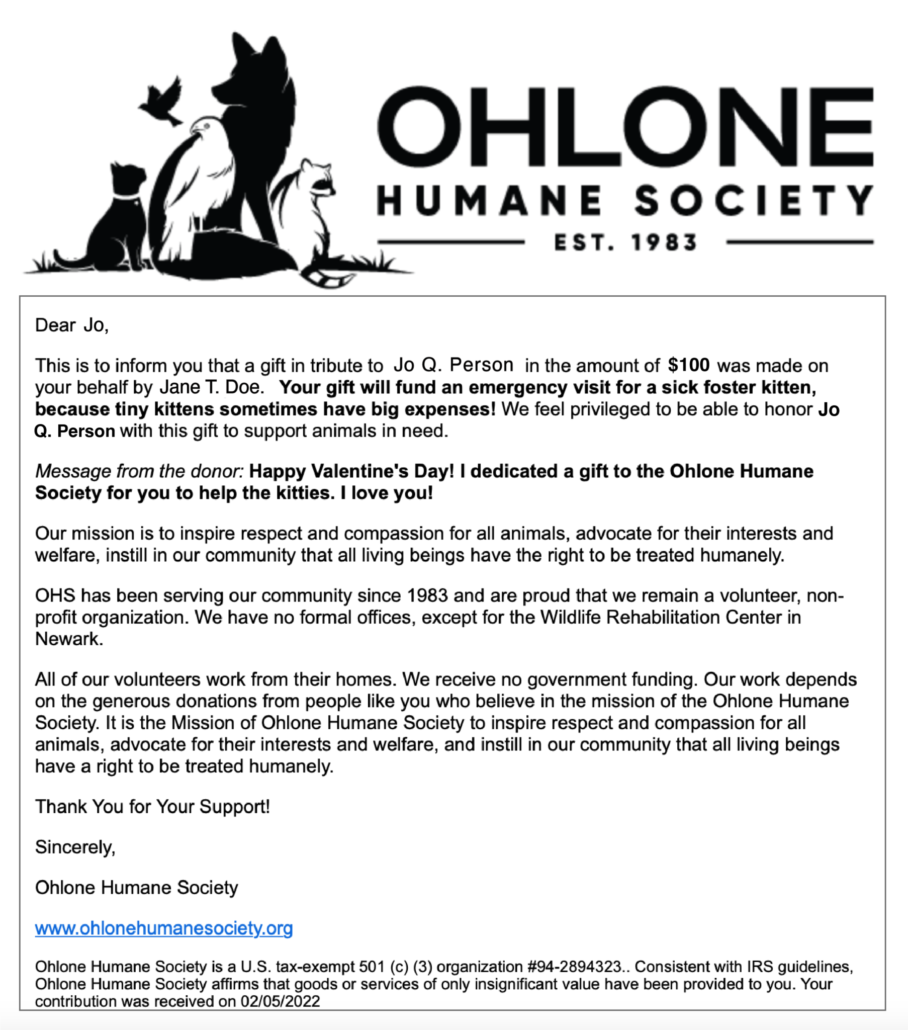

Did you know that there’s a tax savvy way to support animals in our community with just a few clicks?

It’s true! If you are an IRA owner age 70½ or older:

- You can transfer any amount per year, up to $100,000 in 2023, directly to Ohlone Humane Society.

- Your gift is excluded from your adjusted gross income.

- You pay no income tax on the distribution.

- If you are required to take a minimum distribution, you can use your gift to satisfy all or part of that obligation.

- NEW OPTION! You can use your IRA to create a gift that pays you: a charitable gift annuity. Get fixed, reliable income for life by making a one-time election of up to $50,000 (without being taxed on the distribution).

Not 70½ yet? That’s OK! You could name Ohlone Humane Society as a beneficiary of your retirement account no matter your age. It costs you nothing today, and you can name a percentage figure rather than a dollar amount.

Today or Later, Your IRA Can Make a Difference

An IRA is a great way to save for retirement: Make a contribution and enjoy tax savings. Eventually, though, the tax bill comes due—when you take your annual distributions and again when you leave your assets to heirs. If you want to avoid the tax bite and make an impact on our mission, consider a gift to Ohlone Humane Society.

Benefits include:

- See the difference you’re making today.

- Pay no income taxes on the gift. The transfer doesn’t generate taxable income or a tax deduction.

- Bonus: If you are required to take minimum distributions, your gift can satisfy all or part of that obligation.

- Maximize Your Impact Later: You can name Ohlone Humane Society as a beneficiary of your retirement account. This is a great option for extending support from your IRA beyond your lifetime. It costs you nothing today.

Here’s how:

- Contact your IRA administrator for a change-of-beneficiary form, or simply download a form from your provider’s website.

- Name Ohlone Humane Society and the gift percentage on the form.

- Let us know about your plans so we can thank you.